FDD Bootcamp: Live Virtual

Participants will receive the 360-degree view of the overall M&A process from M&A Bootcamp with a detailed understanding of the financial due diligence process and the necessary ‘how to’ tools to perform insightful financial analysis and due diligence from FDD Fundamentals to create a powerful FDD foundation for newer FDD professionals.

CPE credits are available for each course individually*. See below for course requirements, CPE details, and FAQs.

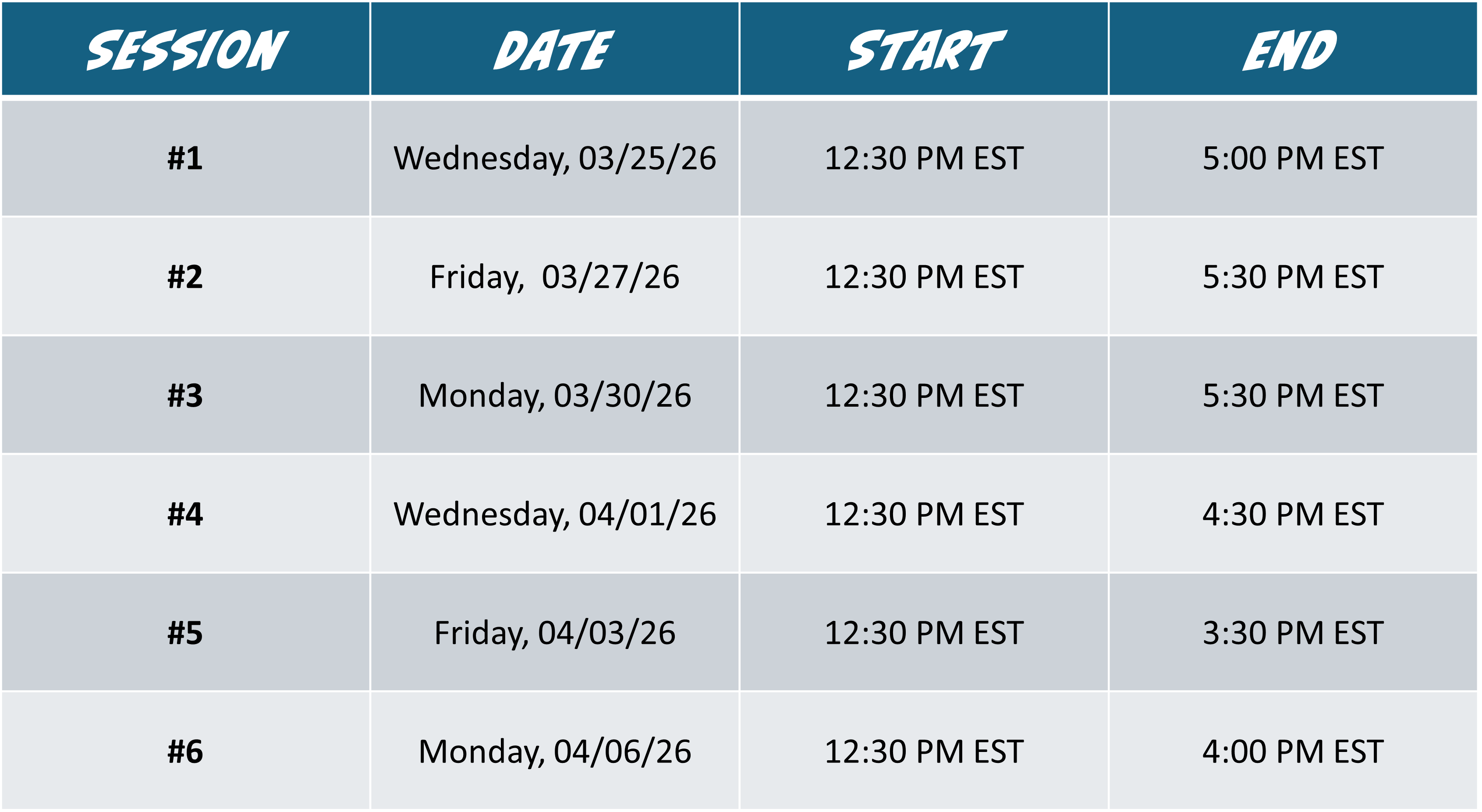

After completion of the self-paced M&A Bootcamp Digital materials, the live virtual sessions start on March 25, 2026. Each session begins at 12:30 Eastern. Sessions last three to five hours. See below for the complete schedule.

Decoding Private Equity

M&A Professions / Audience

Experience Level

Delivery

10-12 Hours

(13 CPE)

26 Hours

(29 CPE)

CPE Credits: M&A Bootcamp Digital

- Last Updated January 2025

- CPE Credit 13

- Fields of Study Finance (10.0 CPE) / Management Services (2.5 CPE) / Personal Development (0.5 CPE)

- Instructional Delivery Method QAS Self-Study

- Knowledge Level Basic

- Prerequisites None

- Advanced Preparation None

- Refund & Cancellation Policy For more information regarding refunds, concerns, and program cancellation policies, please contact the Private Equity Primer Support Team via email at help@pe-primer.com.

- Complaint Resolution For any complaints or issues with course materials or delivery, please email the Private Equity Primer Support Team at help@pe-primer.com.

- NASBA Sponsor Statement Private Equity Primer is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.nasbaregistry.org

CPE Credits: FDD Fundamentals Live Virtual

- Last Updated November 2024

- CPE Credit 29

- Fields of Study Finance (25.0 CPE) / Management Services (2 CPE) / Personal Development (1.5 CPE) / Communications & Marketing (0.5 CPE)

- Instructional Delivery Method Group Live

- Knowledge Level Basic

- Prerequisites None

- Advanced Preparation None

- Refund & Cancellation Policy For more information regarding refunds, concerns, and program cancellation policies, please contact the Private Equity Primer Support Team via email at help@pe-primer.com.

- Complaint Resolution For any complaints or issues with course materials or delivery, please email the Private Equity Primer Support Team at help@pe-primer.com.

- NASBA Sponsor Statement Private Equity Primer is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.nasbaregistry.org

Learning Objectives

- Achieve

a comprehensive understanding of the mergers and acquisitions (“M&A”)

process, including the roles of various transaction participants and diligence

service providers.

- Cultivate

essential business skills and habits that create value (“HTCV”) and become a

well-rounded deal professional capable of effectively navigating tricky

situations found in a variety of transaction settings.

- Understand

and analyze the perspectives of various parties involved in M&A

transactions. Participants will learn to think like investors and recognize how

viewpoints differ across investor types (e.g., strategic vs. private equity),

investment stages (e.g., venture capital, growth equity, recapitalizations,

buyouts), and investment strategies (e.g., types of businesses and investments

typically pursued).

- Conduct core FDD analyses

by performing common financial due diligence tasks such as quality of earnings

adjustments, EBITDA adjustments, net working capital analysis, and identifying

debt and debt-like items utilizing Excel and mini-case studies that reflect

real-world industry scenarios.

- Gain proficiency in financial data

processing and reconciliation techniques by learning

how to map and trend trial balances, clean and reconcile data, and perform cash

proofs, ensuring the accuracy and integrity of financial information for due

diligence purposes.

- Understand and apply the key

workflows and best practices in the FDD process,

including detailed timelines, engagement steps, and strategies for managing

both buy-side and sell-side transactions, from initial assessment through final

report preparation.

- Navigate the transaction process

by learning the roles, responsibilities, and typical deliverables for FDD

professionals across various stages of a deal, with a focus on addressing the

specific considerations and challenges that arise in both buy-side and

sell-side engagements.

- Develop the ability to create and

present comprehensive FDD databooks, synthesizing

complex financial data and analyses into clear, well-structured reports that

provide actionable insights and support decision-making throughout the

transaction process.

Course Details

Essential Business Skills

- Habits That Create Value & Their Applicability to Careers in M&A

- Personal Execution Process: Imagining & Managing the Day©

- Fundamentals: Active Reading, Listening, & Note-taking

- Fundamentals: Synthesize & Reflect

- Fundamentals: The Art of Asking Good Questions

- Fundamentals: Framing, Language, & Communication

The M&A Process

- Cast of Characters: Buyers & Sellers, and Their Many Advisers

- Financial vs. Strategic Investors Different Types of Investors & Form of Investment

- Where Investors Sit Along the Risk / Reward Continuum

- Primary vs. Secondary Capital

- Pre-Money vs. Post-Money Valuations

- Business Lifecycle & The Investment Continuum

- Major Milestones in the Transaction Process

- Common Diligence Workflows & Third-Party Advisers

- M&A Process Considerations & Impact

- Diligence Advisory Firms & Process Type

Foundational Questions©

- Introduction to Foundational Questions©

- Foundational Questions© as the Question Behind the Question

- Project / Client Foundational Questions©

- Company / Target Foundational Questions©

- Foundational Questions© Exercise

Learning to Think Like an Investor

- How Businesses are Valued

- Relative and Absolute Value

- Free Cash Flow (“FCF”)

- Three Sought-After Attributes of FCF

- Desirable Business Traits & Their Impact on FCF

- The Importance of Perspective

- Risk & Opportunity

- Billionaires Brawl

Intro to Private Equity

- Private Equity vs. Institutional Private Equity

- Private Equity vs. Public Equity Comparison

- Other Investor Types Similar to Private Equity

How Private Equity Works

- Private Equity’s Prominence & Reach

- How a Buyout Works

- How Institutional PE Works

- Investment Horizon / Hold Period

- How PE Firms are Structured: A Simplified Example

- PE Firms as Broader Multi-Strategy Asset Managers

- PE Firm Activities

- The Investment Box

- The PE Deal Funnel

- AUM vs. Fund Size vs. Dry Powder

- Common Fee Structure in PE

- Other People’s Money

- How PE Returns Are Measured

- The Three Ways PE Firms Make Money

Due Diligence Defined

- Due Diligence Defined

- Intuition Building: Due Diligence Applied to Other Asset Purchases

Select Diligence Frameworks

- Foundational Questions© Revisited

- Prioritization & Decision Gates

- Building Intuition & Establishing Bookends Using Fermi Math

- Finding Insights in Contradictions

- SOPs Create Consistency & Efficiency

- Using Checklists to Reduce Error Rates

Case Study: Prioritizing Diligence to Enhance Decision Making*

*Only available as part of the live course.

Intro to NWC

- Net Working Capital Defined

- NWC and the Cash Conversion Cycle

- Ways Businesses Finance NWC Needs

- How NWC Needs Vary Across Industries & Businesses

- NWC Optimization

- Fluctuations in NWC as Sources & Uses of Cash

FDD Overview

- What is Financial Due Diligence (“FDD”)

- Main Components of an FDD Report (Quality of Earnings, Analysis of NWC, and Debt & Debt-like Items)

- FDD Process Overview & Timeline

- Comparison of General Perspectives on FDD From Corporate vs. Financial Buyer Clients

- Comparison of Accounting vs. Finance

- Comparison of Audited Financial Statements vs. FDD Reports

- Importance of Confidentiality in FDD Work

Getting Clear on Your (FDD) Job

- Role of an FDD Advisory Team to the Client

- Key Roles & Responsibilities of FDD Professional by Experience Level

- Deeper Dive into Roles & Responsibilities of FDD Associates / Sr. Associates

- FDD Process / Project Management—A Deeper Look

- FDD Engagement / Staffing Model

- Being an Independent, Unbiased Resource While Serving Your Client

- Roles & Responsibilities the FDD Job Does Not Include

Buy Side vs. Sell Side FDD Considerations

- Buy Side vs. Sell Side vs. Carve Outs Engagement Comparisons

- Transaction Perimeter

- Databooks vs. Reports vs. Both

- Full Diligence vs. More ‘Phase I’ Type Engagements

- Branded vs. Unbranded Deliverables in Engagements

Main Components of an FDD Report

- Quality of Earnings (EBITDA Adjustments)

- Analysis of Net Working Capital (“NWC”)

- Identification of Debt & Debt-Like Items

- Impact of the Main Components on Price & Terms (Trace Back to LOI and SPA)

- FDD Report as Analyzing Critical Components of Unlevered FCF

- Core Data Sets: Trial Balances and Transaction Level Databases

- Common Starting Points: Reconciliations & Cash Proof

- Other Common Financial Analyses

FDD Process & Timeline

- FDD’s Role in the Deal Process

- Competitive Auction vs. Non-Competitive Process

- Phase I (Key Issues) Report vs. Phase II (Full Scope) Report

- Process & Planning Steps

- FDD Process & Timeline + Key Milestones

- Understanding Client Deadlines That Inform & Dictate Project Timelines (Bid Dates & IC Approvals)

Pre-Diligence

- Spinning Up an Engagement

- Review of Preliminary Info Packets & Foundational Questions©

- Understanding the Client’s Investment Thesis

- Creating the Scope of Work (“SOW”) and Scoping Best Practices

- Internal Team Kick-Off Meeting

- Creating Key Staring Documents: Working Group List (“WGL”), Creating the Information Request List (“IRL”), and Creating a Preliminary Questions List

- IRL Considerations and Best Practices

- Common High Priority Data Requests

- Preliminary Questions List Tips

Diligence

- Virtual Data Room (“VDR”) Review, Management, & Best Practices

- Analysis & Databook Creation

- Common Analyses (Quality of Earnings, Analysis of NWC, and Identification of Debt & Debt-like Items)

- Other Common Analyses (Customer Analysis, Revenue & Gross Margin by Segment, Price vs. Volume vs. Mix, Cash Conversion Cycle Analysis, Industry Specific Analyses, etc.)

- Data Prep & Data Cleaning Tips

- Lead Sheets

- Managing Overseas Teams

- Audit Workpaper Review

- Email Communication Best Practices

- Preparing for Management Visits

- Meeting Agendas & Question Lists

- Active Notetaking Tips in Management Meetings & Calls

- Best Practices & Tips in Asking Questions in Management Meetings & Calls

- Employing Active Listening in Management Meetings & Calls

Report Production & Delivery

- FDD Report Production Process & Best Practices

- Distilling the Data & Prioritizing Key Findings

- Pyramid Principle

- Adherence to Standard Operating Procedures (“SOPs”) to Minimize Rework

- Writing is an Iterative Process: Tips on Writing FDD Reports

- Slide Layout Considerations & Best Practices

- Editing Best Practices

- Panning Out and Attempting to Bulletproof Your Work

- Client Read Out Calls: Considerations & Best Practices

Post-Diligence Support

- Post Report Assistance

- Incorporating FDD Findings into Client Valuation Models

- Updating / Rolling Forward Analysis

- Calls with Third Parties (e.g., lenders, RWI providers)

- Review & Guidance on Purchase Agreement Documentation

- Preparation of Closing NWC Schedule, True-up Calculations, & Advising on Potential Disputes

Hands On FDD Analyses

- Individual & Group Work in Excel, Performing Common FDD Analyses / Databook Creation

- Starting Point Analysis: Processing, Mapping, and Trending Trial Balances

- Starting Point Analysis: Reconciling & Cleaning Data

- Starting Point Analysis: Cash Proof

- Reps on Core Analyses: Quality of Earnings / EBITDA Adjustments, NWC Analysis, and Identifying Debt & Debt-like Items

- Other Common Analyses (e.g., Customer Database / Concentration Analysis, Revenue & Profitability by Product/Service, Channel, or Customer; Price vs. Volume vs. Mix Analysis; Cash Conversion Cycle Analysis, among others)

Live Virtual Session Schedule

Course Requirements

- Personal

Computer Running Microsoft Excel (PC required).

We strongly advise against using a Mac. Excel hotkeys differ on Macs,

and Mac-specific commands and will not be taught as part of this course.

- Full-Sized

Keyboard Recommended. Keyboards with single-function F-keys and a full

ten-key number pad greatly improve efficiency for Excel-based exercises.

- Two

(2) Computer Monitors are Required. This allows participants to

simultaneously view the instruction screen and complete exercises in Excel or

other tools as directed.

- Functioning

Computer Camera. Cameras must remain on throughout all live sessions.

Failure to comply may result in removal from the course without refund.

- Reliable High-Speed Internet. Reliable,

high-speed internet connection that supports continuous video and audio streaming.

- Ability

to Log into Microsoft Teams. Access to Microsoft Teams videoconference

(or similar service as may be used by PE Primer from time to time).

- Timely Completion of Asynchronous Materials. Participants must complete the asynchronous digital M&A Bootcamp materials before the first live virtual session.

- Quiet,

Professional, Non-Public Workspace. Make sure your workplace is a quiet,

professional, and non-public location without visual or auditory distractions. Headphones

with a microphone may be necessary based on your setup.

- Active

Participation is Required. Participants are expected to:

—Ask and answer questions,

—Offer perspectives during discussions,

—Contribute meaningfully to group work, and

—Engage fully during case studies and Excel exercises.

Frequently Asked Questions

Do the FDD Bootcamp Live Virtual and FDD Bootcamp Public courses cover the same information?

How is the Live Virtual version different from the Public version?

For the Live Virtual delivery, participants claiming CPE will be awarded for each component (M&A Bootcamp and FDD Fundamentals) separately based on the difference in delivery methods.

What is the expected time commitment?

- Asynchronous Digital Content (M&A Bootcamp): Approximately 10-12 hours to complete. This component must be finished prior to the first Live Virtual session.

- Pre-Reading of Preliminary Deal Documents: Participants must review a set of preliminary deal documents (e.g., CIM, sell side QofE, LOI) before the Live Virtual sessions begin. This typically takes 1-3 hours, depending on familiarity with the materials.

- Live Virtual Sessions: The course includes six (6) scheduled Live Virtual sessions delivered over several weeks. Each session lasts approximately 3-5 hours, depending on the specific content covered.

Who should participate in this course?

Can multiple people from my firm participate in the training?

Are there prerequisites?

Recommended (but not required): Participants should have a solid working knowledge of Microsoft Excel. If you are not proficient with functions such as SUMIFS, XLOOKUP, EOMONTH, anchoring, paste special, filtering, sorting, etc., we recommend completing ourM&A Excel Essentials asynchronous course beforehand.

Why is this course delivered over multiple sessions across several weeks?

Is there a course workbook?

Shipping outside the continental U.S. or expedited shipping may incur additional fees. Digital copies will not be provided.

What if I cannot attend a scheduled Live Virtual session?

Live sessions are group based. While we understand that the urgency of client work, illness, or other emergencies occur, we cannot plan around all parties' schedules. Attendance is a personal decision and responsibility. Missing any session may cause you to fall behind, and we cannot adjust the schedule for individual conflicts. There is no make-up mechanism for missed sessions.

Are recordings available?

In its sole discretion, if PE Primer suspects a participant or participant's firm of violating any of the terms of service, including but not limited to broadcasting, projecting, relaying, recording, saving screen shots, or having any non-registered party view of listen in on any part of the course, PE Primer may terminate access to the course without refund.

Can my firm substitute a participant due to staffing or other issues?

- The replacement is a full-time employee of your firm, and

- They complete the asynchronous digital content (M&A Bootcamp) before the course begins.

If the original participant started the digital content, additional fees apply. Additional workbook printing/shipping may also incur fees.

If your firm meets these criteria and needs to initiate a substitution, please reach out to us at help@pe-primer.com.

Cancellations are not allowed, and seats are not transferrable to future sessions.

Certificates